Depreciation interest calculator

Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of. When the value of an asset drops at a set rate over time it is known as straight line depreciation.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

It is an effective way to evenly distribute the cost over the beneficial life of the asset.

. The formula is expressed as. Let us take the same example of how to calculate accumulated depreciation that we used in the straight-line method. Depreciation means the products future value is less than.

Depreciation Amount Asset Value x Annual Percentage Balance. The asset cost is 1500 and its usable life is 6 years. Just enter the loan amount interest rate loan duration and start date into the Excel.

First one can choose the straight line method of. A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed. After two years your cars value.

After the completion of its useful life the machine. For more information about or to do. Our car depreciation calculator uses the following values source.

Need to find the total depreciable value of an asset Say a machine is purchased for 200000. An asset has original cost of 1000 and salvage value of. After a year your cars value decreases to 81 of the initial value.

How to Calculate Depreciation Rate. An Appreciation works similarly to compound interest it is the calculating future value of any product within a particular period. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

Annual depreciation amount Original cost of asset - Salvage valuenumber of periods. The calculation formula is. This depreciation calculator is for calculating the depreciation schedule of an asset.

D i C R i Where Di is the depreciation in year i C is the original purchase price or. Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula.

It is the most common and simplest means of calculating depreciation. It provides a couple different methods of depreciation. EBITDAnet incomeinterest expense tax expensedepreciationamortization EB I T DA net income interest expense tax expense.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Straight Line Depreciation Calculator. Lets take an asset which is worth 10000 and.

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. The formula for EBITDA is. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15.

Car Depreciation Calculator

Double Declining Balance Depreciation Daily Business

Compound Interest Definition Formulas And Solved Examples

Compound Interest Definition Formulas And Solved Examples

Compound Interest And Reducing Balance Calculator Vce Geogebra

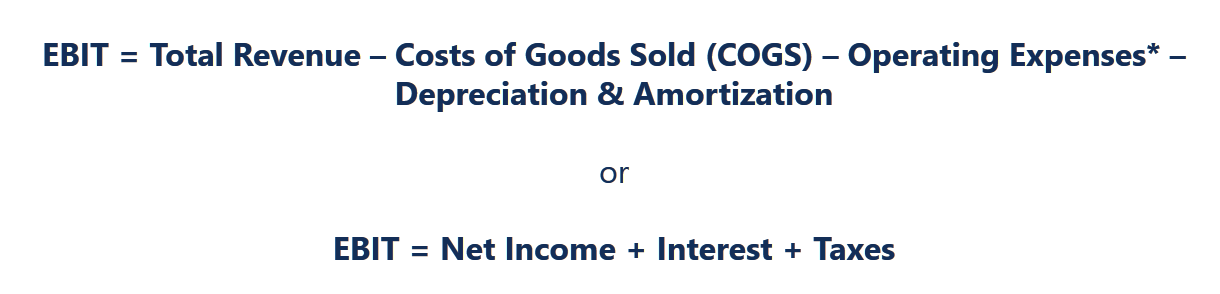

Ebit Earnings Before Interest Taxes What You Need To Know

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Depreciation Archives Page 2 Of 3 Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Compound Interest Definition Formulas And Solved Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

/GettyImages-1086691530-82d69e3d619b47a3883b0c71164a3260.jpg)

Calculate Depreciation Methods And Interpretation

Depreciation Archives Page 2 Of 3 Double Entry Bookkeeping

Auto Finance Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Payment Car Loan Calculator

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Calculate Ebitda With Calculator Wikihow Accounting Basics Calculator Tool Box